Small modular nuclear reactors: how China and the US are poles apart in energy ambitions

-

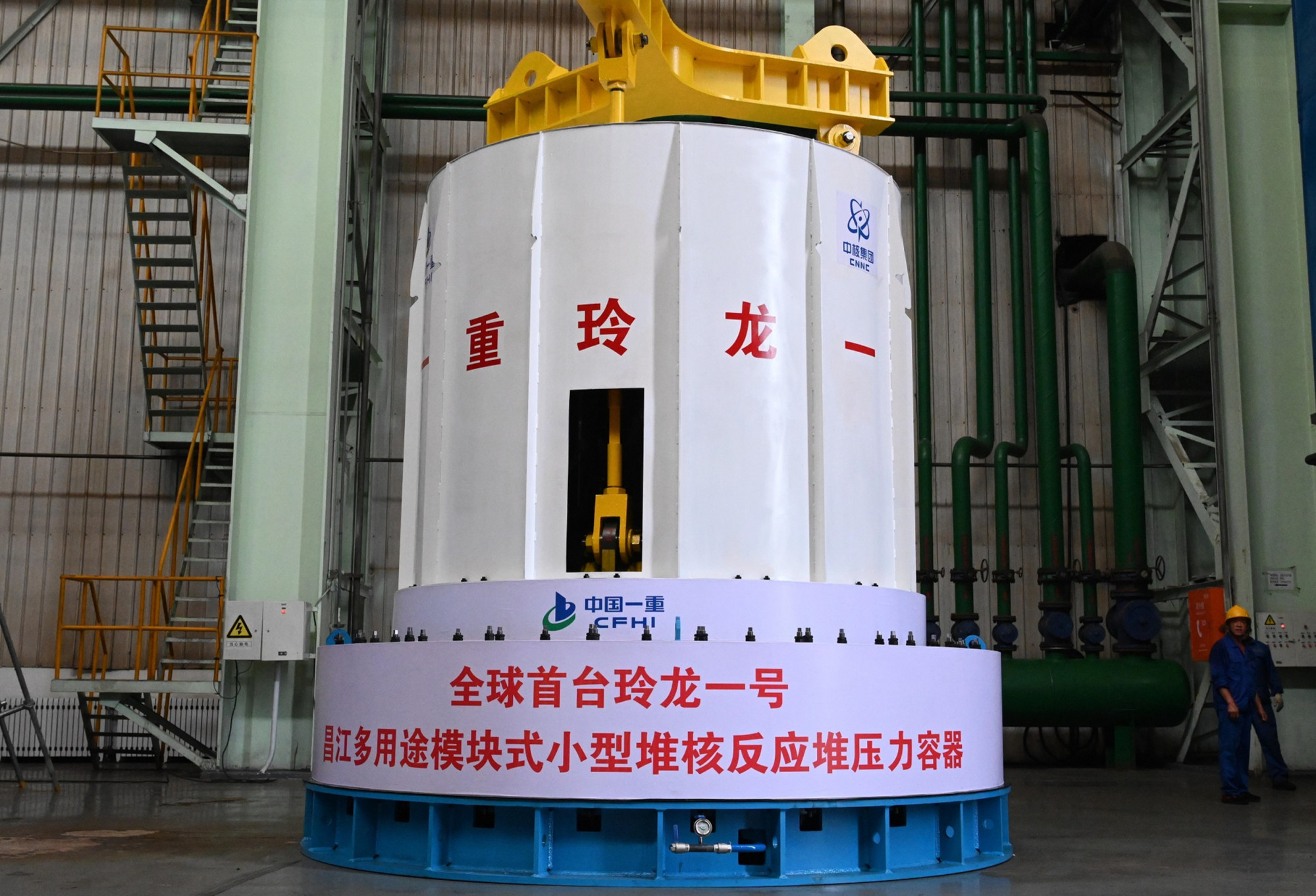

As China stands at the forefront of nuclear energy, work on its Linglong One small modular reactor is progressing

-

But it is a different story in the United States where high costs, lack of staff and delays have seen yet another reactor project shelved

This inconspicuous project is located in Changjiang county, on Hainan province’s northwest coast, right next to China’s southernmost nuclear plant: the Changjiang Nuclear Power Plant. Transport vehicles carrying materials come and go, raising clouds of dust along the road leading to the plant.

In early November, Linglong One announced a milestone: the completion of the reactor’s capsule-like steel safety shell.

It is in sharp contrast to the United States, where, also at the start of last month, a planned project to build a novel six-reactor, 462MW SMR by 2030 was terminated.

03:31

China joins UN mission testing radiation levels near Fukushima plant after waste water release

Oregon-based NuScale Power has the only SMR design certified for use in the US. For its first project, the company was working with a group of Utah utilities at the Idaho National Laboratory, with the aim of generating enough electricity to power more than 300,000 homes. But it cancelled the project over a lack of user subscriptions and rising costs.

“It is too soon to tell if the NuScale project failure is just a temporary setback or a sign of a broader trend in the US,” said Jacopo Buongiorno, professor of nuclear science and engineering at the Massachusetts Institute of Technology. “There are half a dozen other SMR projects in the making.”

Despite its long standing as a nuclear powerhouse, the US is facing challenges in transforming what are great designs on paper into reality, even in the case of small reactors – whereas that is where China is showing its advantages.

SMRs usually have a power capacity under 300 megawatts electric per unit. More than 80 commercial SMR designs are being developed around the world, with various outputs and applications.

It is widely expected that in the post-2030 time frame, SMRs will gradually enter the market. Compared with large reactors, the advantages of small reactors is they are cheaper, simpler and more flexible. Thanks to their small, modular design, they are more affordable to build and are a better fit for smaller grids.

As early as the 1970s and 1980s, due to nuclear accidents at some large-scale nuclear power plants abroad, the International Atomic Energy Agency (IAEA) began advocating for the development of safe, reliable and economically feasible small and medium-sized reactors.

Nations including China and the US aspire to one day export SMRs.

“I believe that Linglong One will become a new name card for China’s nuclear power,” state-owned Science and Technology Daily quoted Song Danrong, chief designer of the project, as saying.

“There is thus a practical demand for SMRs in these places,” he said.

When it comes to nuclear capacity, China has 55 operating reactors and a capacity of over 53GW, which puts it in third place globally behind the US and France. But the nation is quickly catching up.

China has 21 nuclear reactors under construction, which will be able to generate 21.61GW of electricity. That is more than 2½ times more nuclear reactors under construction than any other nation, according to the IAEA.

Kevin Tu, a non-resident fellow at the Centre on Global Energy Policy at Columbia University, said China was at the centre of global nuclear power.

“After the completion of the Daya Nuclear Plant, the first large-scale commercial nuclear power station in mainland China operational since 1994, China has invested heavily on advancing nuclear power technology, with significant inroads made on mechanical engineering, reactor design and equipment manufacturing,” Tu said.

With the rapid development of China’s nuclear power industry over the past three to four decades, “the entire industrial chain has been well-established”, said Zhao Chengkun, executive deputy director of the expert committee of the China Nuclear Energy Association, with around 90 per cent of equipment domestically produced.

Meanwhile, China has established a robust system for cultivating a stable pool of skilled personnel, with a significant demand for professionals in the nuclear power industry and related subjects in higher education, Zhao added.

“China is the de facto world leader in nuclear technology at the moment,” Buongiorno said.

In 2017, Bill Gates’ nuclear firm TerraPower and the China National Nuclear Corporation (CNNC) signed an agreement to develop fourth-generation nuclear technology, though the plan was stranded amid US restrictions on technology deals with China.

“We wish to further international cooperation and achieve technological breakthroughs by developing China’s advantage in rich resources in talent and using internet-based platforms,” China’s then-premier Li Keqiang said at the time.

An article published by CNNC in January said: “Hainan’s Changjiang region has developed into a mature nuclear power base that can provide a supportive and secure framework for small reactor construction. As a free trade port, Hainan will also facilitate greater convenience in exporting.”

And China is also taking a lead in future nuclear technology. On December 6, the world’s first commercial demonstration project of a fourth-generation nuclear power plant, the Rongcheng Shidaowan High-Temperature Gas-Cooled Reactor (HTGR) based in Shandong province, officially started commercial operation.

But America’s nuclear power journey is another story.

Yet nuclear energy is now staging a comeback.

The US is likely to need 200GW of new nuclear generation by 2050 to meet national decarbonisation targets, according to its Department of Energy (DOE). That is almost double its existing capacity.

Nuclear power is also geopolitically significant.

Tu said: “In past decades, construction of greenfield nuclear power plants in Western countries, including the United States, has encountered various setbacks. From less than optimal reactor design to lack of equipment manufacturing capacity – as well as troublesome plant construction – project delays and cost spikes have become a common phenomenon, leading to high risks of conventional nuclear reactor development.”

Compared with renewable technologies with rapidly declining unit costs, the competitiveness of nuclear reactors has become increasingly questionable.

As a result, “both the investors and consumers are increasingly hesitant to bear its high costs”, Tu said.

An International Energy Agency report backed this up, saying that even though advanced economies were home to nearly 70 per cent of installed global nuclear capacity, they had lost market leadership. Recent nuclear power plant projects in Europe and the US had been hit by delays and cost overruns, it noted.

Another more pressing issue in the US, from years of interruptions in nuclear power construction, is a shortage of qualified personnel.

In a 2022 blog post, the American Nuclear Society (ANS) CEO and executive director Craig Piercy said that as the nuclear industry expanded, sector heads were growing more concerned by a lack of workers.

To try to reignite its nuclear industry, the US is pinning much of its hopes on scaling up the market for simpler, less-expensive small modular and advanced reactor technology.

“In recent years, although the United States has permitted several new large-scale nuclear reactors, significant construction delay and major cost overruns have led to Westinghouse’s bankruptcy in 2017 as well as the subsequent cancellation of a project in South Carolina. SMRs are thus given even higher expectations,” Tu said.

The DOE has given NuScale and others about US$600 million since 2014 to support the commercialisation of small reactor technologies.

However, the cancellation of the NuScale project suggested that the vision of using SMRs to reignite the industry is not as easy to do.

In January, NuScale said the target price for power from the plant jumped 53 per cent to US$89 per megawatt-hour, raising concerns about customers’ willingness to pay.

NuScale’s project was the most conventional of the designs and the closest to construction.

“There’s plenty of reasons to think [the other projects] are going to be even more difficult and expensive,” Edwin Lyman, a physicist and director of nuclear power safety at the Union of Concerned Scientists, told Science.

Because of their smaller scale, SMRs, which typically generate power below 300,000kW, do not benefit from the economies-of-scale effect seen in larger reactors that generate millions of kilowatts. Therefore, the unit cost of electricity generation for SMRs is inevitably higher, according to Zhao.

“[China] has an industry that is financed largely by the government and therefore does not need to seek financing from markets that have a return on investment and liability requirements,” Luongo said.

While in China the government provides “cradle-to-grave” financing for the technology, he said, the US government has not committed to fully underwrite the technologies from design to deployment.

07:25

Cop28 prepares temperature check on climate at Dubai meeting

“SMRs under the spotlight have very low generation capacity compared with their conventional gigawatt-scale counterparts; they are at most suitable for limited niche markets without strong consideration of cost-effectiveness. So prospects of SMRs should not be over-exaggerated,” Tu said.

“The termination of NuScale’s contract signals the broader challenges of developing nuclear energy in the United States,” Edwin Lyman said in his November statement, adding that placing excessive reliance on untested technologies without adequate consideration of economic viability, practicality and safety concerns was irresponsible and clearly would not work.

But according to Zhao, the suspension of the NuScale project may not necessarily indicate a major turn of the overall nuclear energy policy in America. He said the US was a global nuclear leader and had been improving its nuclear technology.

In November, the DOE called the cancellation “unfortunate news”, but said first-of-a-kind deployments were often difficult.

“We absolutely need advanced nuclear energy technology to meet [the Biden administration’s] ambitious clean energy goals,” the department said.

“While not every project is guaranteed to succeed, the DOE remains committed to doing everything we can to deploy these technologies to combat the climate crisis and increase access to clean energy.”